Income tax in Netherlands: Taxes are mandated payments that a government organization, whether local, regional, or federal, must make to people or businesses are known as taxes. Taxes support numerous government activities and facilities. Such as Social Security and Medicare as well as public infrastructure and services like roads and schools. This article explains the Dutch tax system, in particular how the yearly income tax return operates.

Income Tax in the Netherlands

Income taxes are levied against individuals or groups based on their earnings or profits. The Wet inkomstenbelasting 2001 regulates personal income tax in the Netherlands, as opposed to corporate income tax (Income Tax Law, 2001). If you work or make money in the Netherlands, you must pay taxes on it. You declare your income tax on your annual tax return (aangifte inkomstenbelasting), which you can do online or with the help of a Dutch tax professional.

Citizens must disclose their income from the preceding year before May 1. The system combines income tax with fees paid for the national insurance system. It is for special medical care, the general old age pension system (AOW), and the pension system for partners of the deceased.

Progressive Tax on Wages

Wage tax is the term for the amount of income tax that will be deducted from your pay if you work for a company (which is contained within payroll tax). The annual tax return is how you calculate and pay your income tax if you work for yourself in the Netherlands. Pensions, social security benefits, and salaries are all subject to a progressive tax. As a result, there are various tax brackets, each with a different tax rate. The tax is a continuous, convex, piecewise linear function of income in mathematics. It is with the exception of discretization (both income and tax are expressed in full euros).

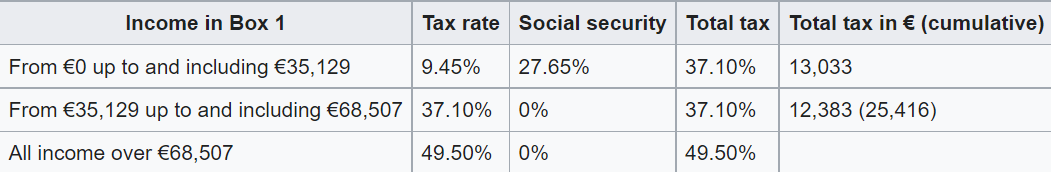

Income listed in Box 1 comprises earnings from a primary residence as well as earnings from a job. Profits from personal business activities, freelance personal services, and some partnership income shares are all taxed as company profits. The percentage of average tax on salary is about 27.65%.

Income in Box 1 is related to progressive tax rates. It has a top tax rate of 49.5% applied to income over EUR68,507. While the year is going on, wage tax is withheld if a Dutch withholding agent is available (pay-as-you-earn). It includes director fees and other employment revenue. Paying wage tax serves as a down payment for the whole amount of income tax that will eventually be due. Excessive severance payments (rate: 75%) and some early retirement payouts (rate: 52%) may subject companies to penalty taxes.

Tax on Employment Income

Salary, earnings, pensions, stock options, bonuses, and allowances are various forms of employment income (for example, home leave and cost of living).

Housing subsidies may be taxed in certain situations. Particular expenses may be reimbursed as a tax-free allowance, but only under certain conditions. In the work-related costs program, the system of tax-free employee benefits and allowances is embodied. This scheme impacts the whole employment conditions policy significantly. Expatriates may be eligible for the 30% facility, a special tax system. This facility provides tax exemptions on up to 30% of specified employment income.